One of the common mistakes businesses make when managing DIO is overlooking the importance of inventory management. Disregarding inventory levels can lead to poor customer satisfaction, high holding costs, and lost sales opportunities due to stockouts. Another common mistake is not tracking inventory levels, which can lead to overstocking and obsolete inventory, resulting in increased storage costs and decreased revenue. DSI is the first part of the three-part cash conversion cycle (CCC), which represents the overall process of turning raw materials into realizable cash from sales.

Best practices for managing inventory levels and DIO

Investing in inventory management software with demand planning features will help you set more accurate stock levels and reduce your holding costs. Another effective strategy to improve DIO is to implement a just-in-time (JIT) inventory system. This system involves ordering and receiving inventory only when it is needed for production or sale, rather than keeping excess inventory on hand. JIT can help businesses reduce storage costs, minimize waste, and improve cash flow.

Sales performance

- Utilising DIO to calculate your cash conversion cycle can build a more accurate picture of sales and inventory performance over time.

- A stock that brings in a higher gross margin than predicted can give investors an edge over competitors due to the potential surprise factor.

- Other factors that can affect DIO benchmarks include the size of the company, the type of products being sold, and the company’s supply chain management practices.

- QuickBooks Enterprise tracks inventory in real-time across warehouses down to the specific bin or pallet with intuitive, multi-level categorization.

- Days Inventory Outstanding (DIO) varies significantly in different industries due to the nature of their operations and the types of inventory they handle.

Knowing these benchmarks helps you determine if your DIO is in line with competitors. If your DIO runs higher, this indicates inventory sits longer before being sold. You likely also have reduced liquidity where your cash funds are tied up in unsold inventory, which can impact your ability to pay short-term debts. This indicates it took the company 36.5 days to convert its inventory investment into cash for the period analyzed. To understand how to calculate DIO, let’s use a hypothetical company — Company Alpha — as the days inventory outstanding example.

The connection to inventory turnover and operational efficiency

At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business. If you are ready to put the average days inventory outstanding formula into practice at your business, take these three simple steps. As an investor, you also need to keep in mind that whether the company has required working capital at any given moment or not.

You can use the DIO formula to measure the performance of your inventory management. A lower number typically means your business is carrying less stock on hand, and therefore spending less on overheads and running more efficiently. Days Inventory Outstanding (DIO) is one of several accounting metrics that help a business measure its effectiveness in converting products and services to cash. As the name implies, it measures how long a business takes to convert its physical inventory into sales.

Interpreting DIO Metrics

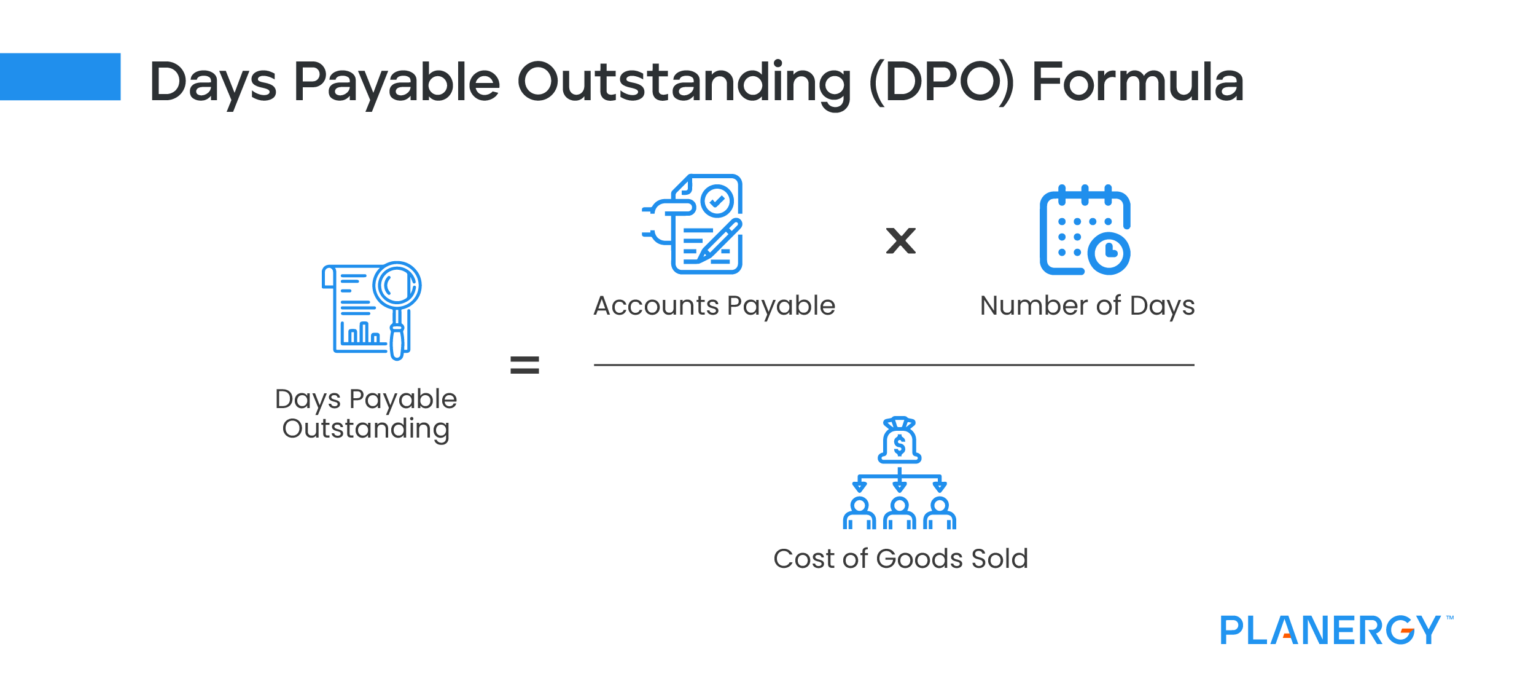

The other two stages are days sales outstanding (DSO) and days payable outstanding (DPO). While the DSO ratio measures how long it takes a company to receive payment on accounts receivable, the DPO value measures how long it takes a company to pay off its accounts payable. By streamlining production, leveraging technology, and analyzing customer behavior, companies can improve their demand forecasting accuracy and reduce stockouts and overstocking.

Optimal turnover is significant for food items and perishable goods that will have to be written off if they spoil. With this in mind, QuickBooks Enterprise allows you to assign expiration dates to inventory, which can help teams take action on soon-to-expire items and reduce losses. The number 365 in the calculation of average days inventory outstanding denotes the number of days in a financial year. However, the period an also be a week or a month or quarter, depending on the company policy. Last, but not least, it is worth noting that DIO does not give you the whole picture of the company’s operation.

This can tie up cash and make it more likely that your inventory will become obsolete. A good Days Inventory Outstanding (DIO) varies depending on the industry and the company’s specific needs. To make this strategy actionable, let’s consider the indicators that should act as focal points when investigating the best ways to improve sales for your specific business.